Our Treasurer stood up at the October stated meeting and announced we had $8,400 in the bank.

Everyone nodded. Sounded good. Meeting moved on.

Two months later, we couldn’t pay Grand Lodge fees. Turned out we had $12,000 in annual expenses and only collected $7,500 in dues.

The $8,400 balance looked healthy. The trajectory was disaster.

Nobody caught it because we were looking at balance, not burn rate. We knew what we had. We didn’t know where we were headed.

That’s how most lodge finances work. Current numbers that hide future problems.

The Balance Isn’t the Story

Every Treasurer reports the same thing: current balance. “We have $X in the bank.”

That number tells you almost nothing useful.

Is $8,400 good? Depends. If you spend $500 a month, you’re fine for over a year. If you spend $1,200 a month, you’re broke by spring.

The balance is a snapshot. What you need is a trajectory. Where are you going, not just where you are.

Here’s what actually matters: monthly income, monthly expenses, monthly net, projected balance six months out, projected balance twelve months out.

Most lodges don’t track this. They know the balance today. They’re guessing about tomorrow.

Financial management isn’t knowing what you have. It’s knowing what you’ll have and planning accordingly.

Track Every Dollar In and Out

This sounds obvious. Most lodges don’t do it consistently.

Cash comes in from dues. Gets deposited. Maybe recorded as “dues.” Maybe just “income.”

Check goes out for utilities. Gets recorded as “electric bill.” Or maybe just “utilities.” Or maybe just “expenses.”

Six months later, someone asks “How much did we spend on utilities last year?” and the Treasurer has to reconstruct it from bank statements.

Here’s the system that works: every transaction gets recorded with date, amount, category, and description.

Not “income” but “dues – Brother Johnson.” Not “expenses” but “utilities – electric – May 2024.”

This takes thirty seconds per transaction. It saves hours when you need to analyze anything.

You want to know how much you spent on building maintenance last year? Filter by category. You want to know if utilities are going up? Look at the trend. You want to know who hasn’t paid dues? Check the category.

None of this works if your records are vague.

Categories That Actually Help

Most lodges have two categories: income and expenses. That’s useless for planning.

You need income categories: dues, donations, rentals, investments, fundraising, other.

You need expense categories: utilities, supplies, maintenance, insurance, charitable giving, Grand Lodge fees, professional services, other.

Why? Because “we spent $24,000 last year” tells you nothing. “We spent $6,000 on utilities, $4,000 on insurance, $3,000 on maintenance, $8,000 on Grand Lodge fees, $2,000 on charitable giving, and $1,000 on supplies” tells you everything.

Now you can budget. Now you can cut if needed. Now you know where money actually goes.

Most Treasurers resist categories because it feels like extra work. It’s not. It’s the same work with better labels.

And it makes everything else easier.

The Monthly Reconciliation Nobody Does

Your bank statement says one thing. Your records say another. Which is right?

Most Treasurers assume their records are right until the bank statement proves them wrong. Then they adjust and hope it matches.

Here’s what should happen every month: pull the bank statement, compare every transaction to your records, mark each transaction as reconciled, investigate any discrepancies immediately.

This takes fifteen minutes. Most lodges skip it.

Then three months later, there’s a $500 difference nobody can explain. Was it a missed deposit? A forgotten check? A recording error? Who knows.

Monthly reconciliation catches errors when they’re fresh. You remember that cash donation from last week. You remember writing that check.

Quarterly reconciliation means digging through memory and hoping you’re right.

Do it monthly. Every time. No exceptions.

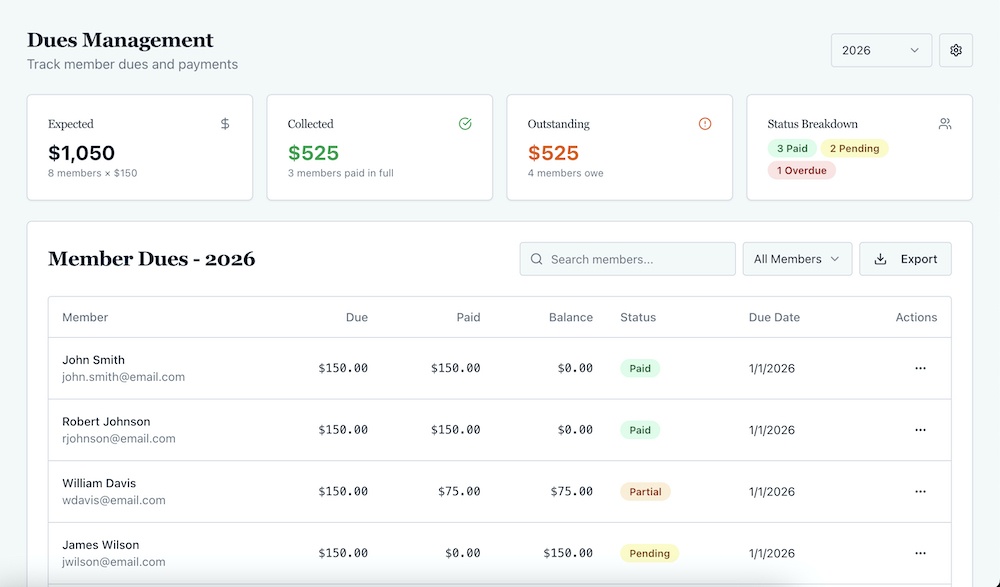

Dues Income Isn’t Income Until It’s Collected

Your lodge has 60 members. Dues are $200. That’s $12,000 in annual income, right?

Wrong. That’s $12,000 in expected income. Actual income is what you collect.

Most lodges budget based on total membership. Then they’re confused when they’re short.

Brother Smith is three years behind. Brother Jones claims hardship. Brother Williams stopped responding. Brother Davis moved and nobody has his new address.

You’re not getting $12,000. You’re getting $9,500 if you’re lucky.

Budget for what you’ll actually collect, not what the books say you should collect. Look at last year’s collection rate. Use that.

If you collected 80% last year, budget for 80% this year. Hope for better, plan for realistic.

Lodges get in trouble when they budget for perfect compliance. Nobody has perfect compliance.

Know Your Burn Rate

How long until you run out of money?

Not “do we have enough money.” How many months until the balance hits zero at your current spending rate.

This is the most important number in lodge finances. Most Treasurers can’t answer it.

Here’s how to calculate it: take your average monthly expenses for the last six months, take your average monthly income for the last six months, subtract expenses from income to get your monthly net.

If your net is negative, divide your current balance by your monthly deficit. That’s how many months until you’re broke.

If your net is positive, you’re fine. For now. But check it quarterly because things change.

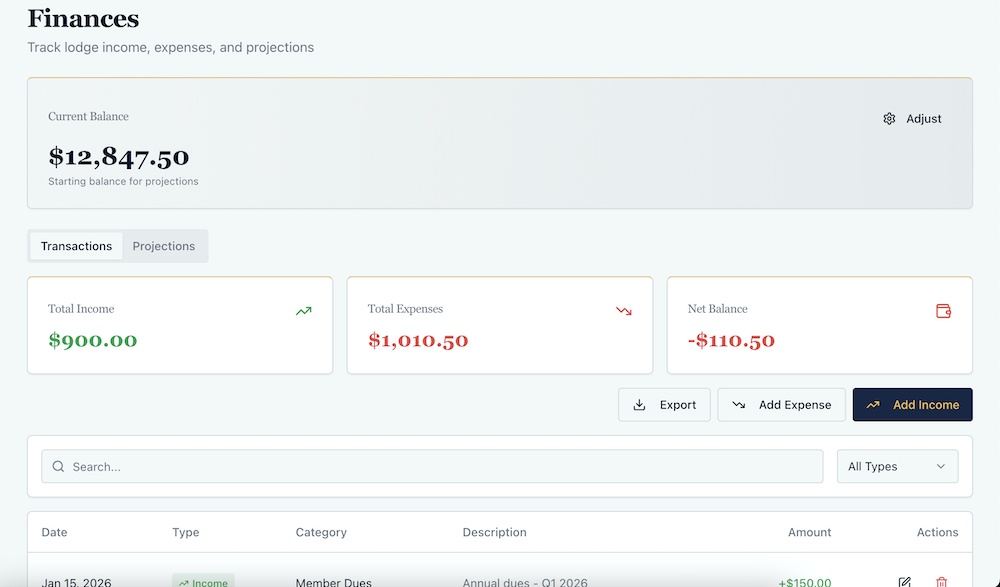

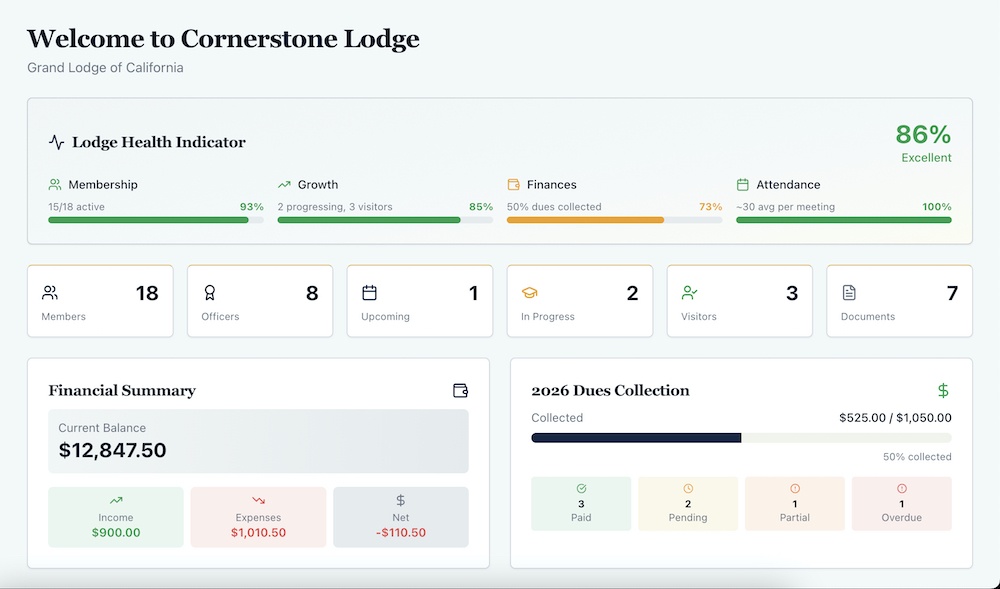

We started tracking this when we moved to Masonic Lodge Secretary.

Turns out we were running a monthly deficit of about $400. With $8,400 in the bank, we had 21 months until crisis.

That sounds like plenty of time. But 21 months becomes 15 becomes 9 becomes 3. And suddenly you’re scrambling.

Knowing your burn rate means you can act before it’s urgent. Raise dues. Cut expenses. Plan fundraising. Whatever you need to do, you can do it calmly instead of desperately.

The Projection Most Lodges Skip

Every lodge should project finances twelve months out. Almost none do.

Here’s why it matters: you know your annual expenses, you know your expected dues income, you know your current balance.

You can build a simple month-by-month projection.

January: starting balance $8,400, dues income $1,500, expenses $800, ending balance $9,100.

February: starting balance $9,100, dues income $500, expenses $800, ending balance $8,800.

March: starting balance $8,800, income $200, expenses $800, ending balance $8,200.

Keep going. By June, you’ll see exactly when you run into trouble. By December, you’ll know if you need to change course.

This isn’t complicated math. It’s addition and subtraction. But it shows you the future instead of just the present.

Most lodges don’t project because it feels pessimistic. Like you’re expecting failure.

It’s not pessimistic. It’s realistic. And it lets you fix problems before they become emergencies.

Transparency Builds Trust

Your members should know the financial situation. Not just “we have money” or “we’re fine.” Real numbers.

How much income? How much in expenses? What’s the balance? What’s the trajectory?

Most lodges treat finances like a secret. The Treasurer reports a balance. Maybe income and expenses if someone asks. That’s it.

Members don’t trust what they can’t see. They wonder if money’s being mismanaged. They assume things are worse than they are. Or better than they are. Nobody knows.

Here’s what works: monthly financial summary at every stated meeting. Current balance, month’s income by category, month’s expenses by category, year-to-date totals, brief commentary on anything unusual.

Three minutes. Complete transparency. No surprises.

Members who see the numbers trust the numbers. Members who only hear “we’re fine” wonder what’s being hidden.

Even if nothing’s being hidden, secrecy creates suspicion.

The Budget Nobody Follows

Most lodges create an annual budget. Pass it at the first meeting. Never look at it again.

Six months later, expenses are way over budget in some categories and under in others. Nobody noticed because nobody’s comparing budget to actual.

Here’s the point of a budget: it’s a plan. You’re supposed to check if you’re following the plan.

Monthly comparison: budgeted income versus actual income, budgeted expenses versus actual expenses, any significant variances get discussed.

If you budgeted $600 for utilities and you’re spending $800, that’s a problem. You need to adjust either the budget or the spending.

If you budgeted $1,000 for maintenance and you’ve spent $200, you’re either behind on maintenance or you overestimated. Either way, you should know.

A budget you don’t monitor is useless. It’s just a document that made everyone feel responsible once.

Separate Accounts for Separate Purposes

Your lodge has operating funds and building funds. Maybe scholarship funds. Maybe charity funds.

Are they in separate accounts or all mixed together?

Most lodges mix everything. Then they try to track it with internal accounting. “We have $15,000 total but $8,000 is building fund so really we have $7,000 operating.”

This falls apart immediately. You forget which expenses came from which fund. You move money between funds without documenting it. Six months later, nobody knows what’s what.

Here’s what works: separate bank accounts for separate purposes. Operating account for day-to-day expenses. Building account for capital expenses. Charity account for charitable giving.

Now you can’t accidentally spend building fund money on utilities. The accounts themselves enforce the boundaries.

This isn’t complicated. Most banks let you open multiple accounts under one organization. Do it.

The Emergency Fund You Don’t Have

Your furnace dies. $4,000 to replace. Where does that money come from?

Most lodges don’t have an answer. They either delay the repair, do an emergency assessment, or drain the operating account and hope to recover.

Every lodge needs an emergency fund. Separate from operating. Separate from building capital. Just for unexpected expenses.

How much? Start with three months of operating expenses. If you spend $1,000 a month on average, you need $3,000 in emergency reserves.

This isn’t money you invest or spend. It’s insurance. It sits there until you need it.

Most lodges resist this because it feels like money doing nothing. It’s not doing nothing. It’s preventing future panics.

Build it slowly if you need to. $100 a month. In two years, you’ll have enough to handle most emergencies without financial crisis.

Simple Systems Beat Perfect Systems

You don’t need complex accounting software. You don’t need professional bookkeepers. You don’t need elaborate spreadsheets.

You need simple systems that actually get used.

Record every transaction with enough detail to be useful. Reconcile monthly. Review spending against budget. Project forward. Report transparently.

That’s it. Do those five things consistently and your finances will be in better shape than 80% of lodges.

The lodges that fail financially don’t fail because their systems are too simple. They fail because they have no systems at all.

For us, putting finances in Masonic Lodge Secretary meant we could finally see everything clearly. Income and expenses categorized automatically. Balance projections built in. Monthly burn rate visible at a glance.

Not because we needed fancy features. Because we needed the basics done consistently without thinking about it.

When to Raise Dues

Nobody wants to raise dues. Every lodge waits too long.

Here’s the trigger: if your projected twelve-month burn rate shows you’ll be broke in two years, raise dues now.

Not in two years when you’re desperate. Now, while you still have time and options.

Most lodges wait until crisis. Then they do emergency increases that make members angry. Or they don’t raise dues and slowly die.

Dues should go up gradually and regularly. Small increases members can absorb. Not big jumps that cause rebellion.

If your expenses go up 3% annually due to inflation, your dues should too. Every three years, small adjustment. Keeps pace with costs. Nobody panics.

Waiting ten years and then doubling dues to catch up? That’s how you lose members.

The Financial Dashboard You Need

Your lodge’s financial health should be visible at a glance. Not buried in reports. Not hidden in the Treasurer’s head.

Current balance. This month’s income. This month’s expenses. Year-to-date totals. Twelve-month projection.

That’s your dashboard. Five numbers. Updated monthly.

The Worshipful Master should be able to look at this any time and know if the lodge is healthy or headed for trouble.

Most lodges don’t have this visibility. The Treasurer knows. Maybe. Everyone else is guessing.

Financial surprises shouldn’t exist. Not in an organization where money flows predictably.

Dues come in mostly in Q1. Grand Lodge fees go out mid-year. Utilities are consistent. You know this.

So project it. Track it. Make it visible.

When finances are transparent and projected, there are no surprises. Just decisions made with time to make them well.

Start With What You Can Control…

You can’t control unexpected expenses. You can’t control every member paying dues on time. You can’t control what Grand Lodge charges.

You can control tracking every transaction.

You can control reconciling monthly.

You can control knowing your burn rate.

You can control projecting forward.

Start there. Get the basics right. Everything else gets easier.

Your lodge’s finances aren’t complicated. They’re small scale. Predictable. Manageable.

The problems come from not managing them. From assuming “we’re fine” without checking. From reacting to crises that could have been prevented.

Financial health isn’t about having a lot of money. It’s about knowing exactly where you stand and where you’re going.

Most lodges don’t know. They should. The information’s all there. You just have to look at it.